Chaudhary Ventures

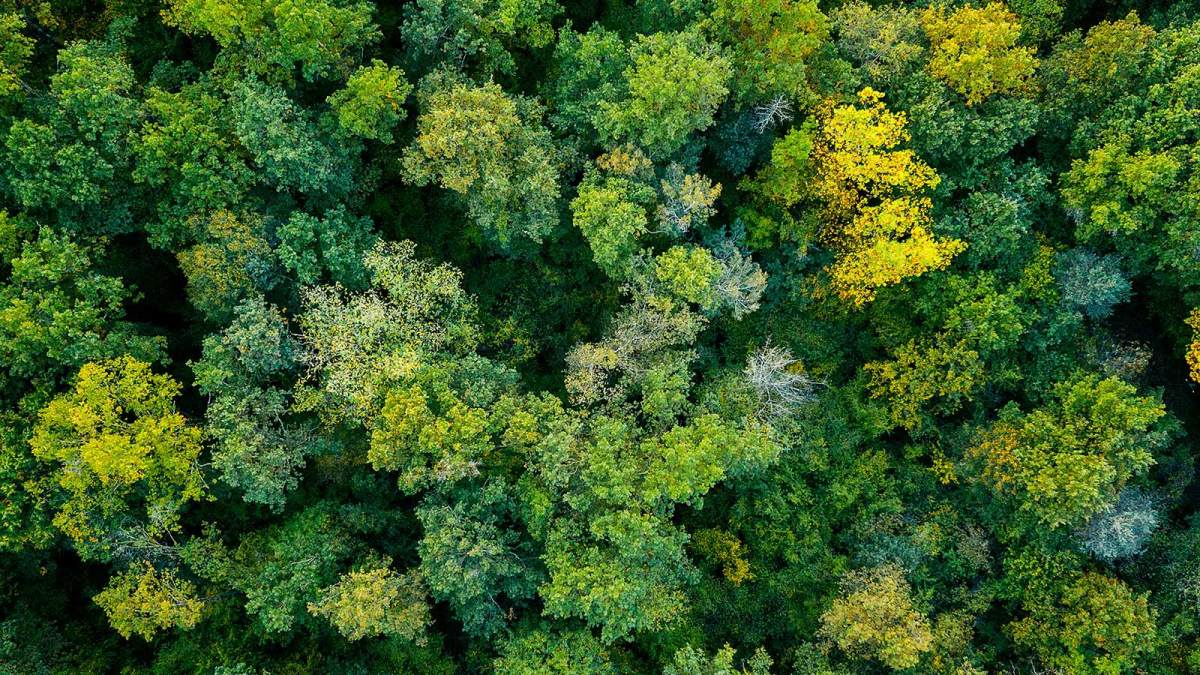

At Chaudhary Ventures, we back bold visions with smart funding. From early-stage to scale-up, we empower startups with capital, mentorship, and access to a powerful ecosystem.

Our Story

Chaudhary Ventures empowers startups and growth-stage businesses with smart capital, strategic support, and deep industry expertise. We partner with visionary founders to turn bold ideas into scalable ventures.

Why Join Chaudhary Ventures?

From seed to scale, we support startups throughout their fundraising journey — with direct capital, investor matchmaking, and pitch refinement to secure the right funding at the right stage.

End-to-End Fundraising & Investment Support

Our investments come with more than just money. We bring operational expertise, mentorship, and hands-on support to help you deploy capital efficiently and accelerate growth.

Smart Capital with Strategic Value

Chaudhary Ventures connects you to a curated network of co-investors, syndicates, and institutional partners ensuring continuous capital access as your venture evolves.

Access to a Trusted Funding Ecosystem

Funding Steps

Submit Pitch Deck and Evaluation Form

Founder’s Call

Business and Financial Due Diligence

Issuing of TermSheet, Legal documentation and Funding

Tech Advice And Solutions If Needed

Voting and Initial Screening

Feedback Report on Founder’s Call

Commitments

Market Sizing + Milestone Metrics

Post Funding Engagement

Process Done

Explore Our Diverse Sectors

Developing Go To Market Strategy

Crafting effective market entry and expansion strategies to maximize reach and impact.

Financial Modelling

Building detailed financial models to support decision-making and investment planning.

Corporate Strategy

Defining long-term strategic goals to drive sustainable competitive advantage.

Operational Strategy

Streamlining operations to enhance efficiency, productivity, and cost-effectiveness.

Business Planning

Creating comprehensive business plans aligned with organizational objectives.

M&A Strategy

Supporting mergers and acquisitions through strategic planning and synergy analysis.

Data Analytics

Leveraging data insights to inform business decisions and uncover growth opportunities.

Workflow Optimization

Enhancing business processes to improve speed, quality, and performance.

IPO Strategy

Preparing companies for public listing through strategic, financial, & regulatory readiness planning.

The Team

CFA, CIO & CFO

Satya Prakash

satya@gmail.com

CEO & CTO

Kumar Shanu

shanu@gmail.com

Chief Operating Officer

OM Prakash

om@gmail.com